is a car an asset or expense

Guaranteed asset protection GAP insurance is less scammy than the previously mentioned coverage plans that dealers often push. Yes with the DDD balance method the depreciation factor is 2x that of the SLD or Straight Line Depreciation method.

Is Your Car An Asset Or A Liability

Easily an Airport painting job for an entire building may pass the first requirement but not the second.

. Therefore that purchase isnt considered an expense. You are still locked into the deal for a contracted number of months and a monthly payment. This is both GASB and GAAP.

If the fully depreciated car continues to be used there will be no further depreciation. If you total a car shortly after financing it your insurance company will compensate you for the value of the car which thanks to depreciation is often less than what you owe on the loan. Get a new car loan and insurance approved in 12 hours.

Office supplies fall in the asset category but they are purchased for consumption meaning it can fall into an expense category. When it comes to expense the asset it provides you with the deduction in the. If a person owns a car instead of leasing it the residual value would equal the salvage value of the car minus any costs to dispose of the car.

A car is considered an asset that is expected to have a useful life of more than one year. If the business use percentage is only 50. It should extend the useful life of the old asset or it should expand the assets service utility.

The expense happens when a car loses value. If a cost does not meet 1 and 2 then it should be expensed as maintenance expense. Instead we can use the straight-line method to calculate amortization expense over the licenses 10-year term.

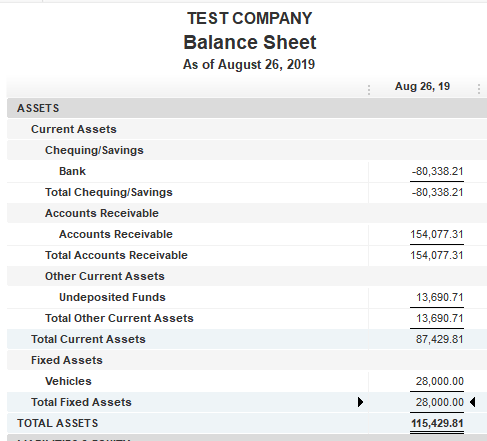

If the market value of an asset changes materially US. Accounting Entries for a Fully Depreciated Car. Use the cash type bank account and enter the purchase use the fixed asset account as.

Residual Value and Purchased Assets. Learn about Allstates coverage and policies to see how we can help you protect your home from personal umbrella insurance to dwelling coverage and more. Create the Fixed asset type account in the chart of accounts and name it create a sub fixed asset account named accumulated depreciation-asset name.

An asset is a resource with economic value that an individual corporation or country owns or controls with the expectation that it. When you declare business assets as an expense you usually get a larger. Calculating the Depreciation for a Vehicle.

The maximum that can be deducted is 3160 in the 1 st year without the bonus depreciation 5100 in the 2 nd year 3050 and 3 rd year and 1875 in the 4 th and later years until the car is fully depreciated. The company cannot depreciate more than the cars cost. Last Expense MEDICAL Cigna Global International Health Health Insurance.

A fully depreciated car is one where the cars historical cost has already been allocated to expense except for the estimated salvage value if any. A new IRS rule the De Minimis Expense Threshold lets you deduct the entire cost of items less than 2500 as an expense instead of an asset. Unlike financing a car purchase based on you eventually owning the car leasing is like a long-term rental.

You buy a vehicle for 30000 and use it 100 for business. A good example is a car which can lose 30 of its market value as soon as you drive it off the lot but its book value on the balance sheet will still be pretty close to the purchase price. Additionally the practical fact reveals that any asset think of buying a new car loses more its value in the very first few years of its use.

No queues branch visits or lost documentation. When you buy a car you are trading one asset money for another your car so it is assumed you have the same total of assets after the purchase. Each year you can claim a 10000 depreciation expense until the liquor license expires after ten years.

Although the revenue produced helps make up for this inevitability the fact remains that driving or renting out your car for extra income means your side hustles indispensable asset becomes less valuable at a comparatively rapid rate. Our Asset Finance application portal is the first of its kind and couldnt be more convenient. Speed it up and move into fifth gear.

GAAP only allows downward adjustments from historical cost which are called impairment losses. If the purchase price of an asset is more than 2500 you have to claim it as an assetThat also means you need to track its depreciation. Heres how to classify them.

Finally consider the opportunity cost of using your car to earn extra income. Since its an asset you cant immediately claim a 100000 write off for the year you purchased the license.

Tips For Maintaining Your Company Car For Expense Control And Safety Car Dealer Car Lease Car Finance

Invest Into Assets First Investing Business Ideas Entrepreneur Personal Finance

Is My Car An Asset Or A Liability

Capital Expenditure Accounting Capital Expenditure Accounting Cash Flow Statement

Is Your Car An Asset Or A Liability

Is A Financed Vehicle An Asset Mediation Advantage

How Do I Remove A Fixed Asset An Old Vehicle That

Is Your Car An Asset Or A Liability

Accrued Rent Journal Entry Accounting Books Accounting And Finance P S Of Marketing

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Balance Sheet Excel Spreadsheets Restaurant Business Plan

Is A Car An Asset What You Need To Know Clever Girl Finance

1946 Triumph 1800 Roadster Roadsters Triumph Motor Jaguar Roadster

Personal Finance Spreadsheet Bundle Google Sheets Etsy Espana Personal Finance Emergency Fund Finance

Professional Company Car Allowance Policy Template Policy Template Policies Templates

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy In 2022 Balance Sheet Check And Balance Debt To Equity Ratio

/Familybuyingnewcar_skynesher_CROPPED_Eplus_Getty-2a8c993cd0c146da9cdcd5c293f766b2.jpg)